Helping you save better

Be it your next vacation, your first home, or saving for the future, our simple savings accounts can help you get there.

READ MORE

For a secure and Planned Future

Our Fixed Deposit Accounts, let you know exactly how much you can save without any hidden costs or fees.

READ MORE

Rates so low, you won't think twice.

Get the ideal family car, or a fun and efficient electric car. We have the ideal car lease for your stress-free, daily commute.

READ MORE

Dream it, get it, make it happen

Unlock the Power of Your Gold with Our Hassle-Free Gold Loan Facility - Get Instant Cash Today!

READ MORE

Lanka Rating upgrades Lanka Credit & Business Finance PLC

Lanka Rating upgrades Lanka Credit & Business Finance PLC

READ MORE

LATEST NEWS

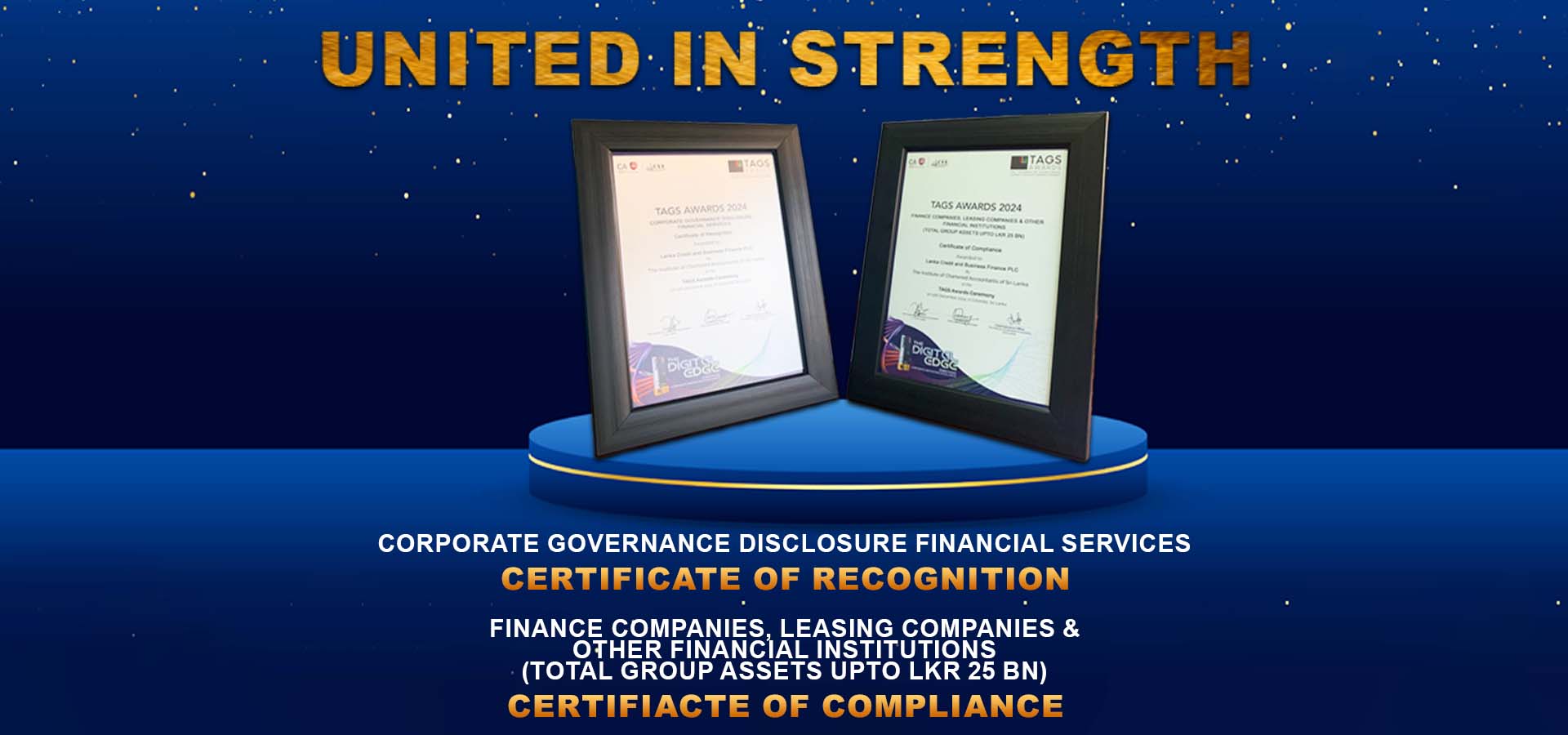

The Trusted Finance Partner Award in Sri Lanka Read more

(+94) 11 28 25 404

(+94) 11 28 25 404  info@lcbfinance.lk

info@lcbfinance.lk